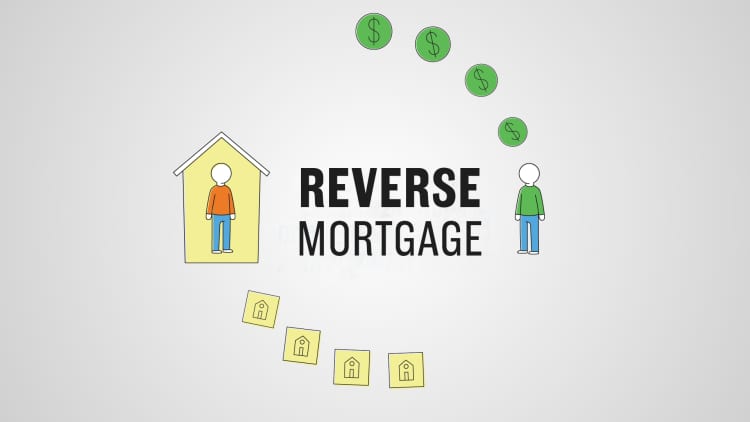

A reverse mortgage loan allows homeowners to get a loan against their home, just like a traditional mortgage. Like a traditional mortgage, with a reverse mortgage, the ownership of the home remains in your name. However, unlike a traditional mortgage, a reverse mortgage does not require the borrower to make monthly mortgage payments. When the borrower no longer lives in the home, the loan is repaid. Each month interest and fees are added to the loan balance and the balance grows.

With a reverse mortgage loan, homeowners are required to pay property taxes and homeowners insurance, use the property as their principal residence, and keep their house in good condition.

A reverse mortgage is a type of loan that is used by homeowners at least 62 years old who have considerable equity in their homes. By borrowing against their equity, seniors get access to cash to pay for cost-of-living expenses late in life, often after they’ve run out of other savings or sources of income. Using a reverse mortgage, homeowners can get the cash they need at rates starting at less than 3.5% per year.

With a reverse mortgage, the amount the homeowner owes the lender increases over time rather than decreases. This is because interest and fees are added to the loan balance each month. As the loan balance increases, the net worth decreases.

Reverse mortgages are not free money. Money borrowed + interest + monthly fee = loan that increases the loan balance.

The homeowner or his or her heirs will eventually have to sell the home to pay off the loan.

The process of using a reverse mortgage is very simple. Start with the borrower who already owns the home. The borrower has a substantial equity interest in the home (usually at least 50% of the value of the property) or has paid off the full amount. Borrowers determine they need the liquidity that comes with removing capital from their homes and work with reverse mortgage advisors to find lenders and programs.

A borrower applies for a loan after selecting a specific loan program.

The lender does a credit check, reviews the borrower’s property, its title and appraised value. If approved, the lender funds the loan, with proceeds structured as either a lump sum, a line of credit or periodic annuity payments (monthly, quarterly or annually, for example), depending on what the borrower chooses.

After a lender funds a reverse mortgage, borrowers use the money as provided for in their loan agreement. Some loans have restrictions on how the funds can be used (such as for improvements or renovations), while others are unrestricted. These loans last until the borrower dies or moves, at which time they (or their heirs) can repay the loan, or the property can be sold to repay the lender.

The borrower gets all the money left over after paying off the loan.

You have the right to cancel a reverse mortgage within 3 days.

With most reverse mortgages, you can cancel the transaction for any reason within 3 business days of closing the loan without penalty. This is referred to as the “Cancel Agreement” right. Cancellation requires notice in writing to the creditor. You can check the time the letter was sent by registered mail and requested proof of receipt and the time the creditor received notice of cancellation.

Keep copies of communications between you and your lender. After you cancel, the lender must return any amount you paid to finance the reverse mortgage loan within 20 days.