A credit score is a prediction of credit behavior, such as the likelihood of paying off a loan on time, based on information in your credit report.

Companies use your credit score to decide whether to offer mortgages, credit cards, auto loans and other loan products, and to screen renters and insurance. It is also used to determine the interest rate and credit limit you receive.

The company uses a mathematical formula called a scoring model to generate a credit score based on the information in your credit report.

Factors commonly considered in credit scoring models include: Debt foreclosures, foreclosures, bankruptcies, and how long ago you have a credit rating of “one” or higher. Each credit score is different depending on the data used to calculate it, the scoring model (which may depend on the type of credit product the rating will be used for), the source of the data used and even the date it was calculated.

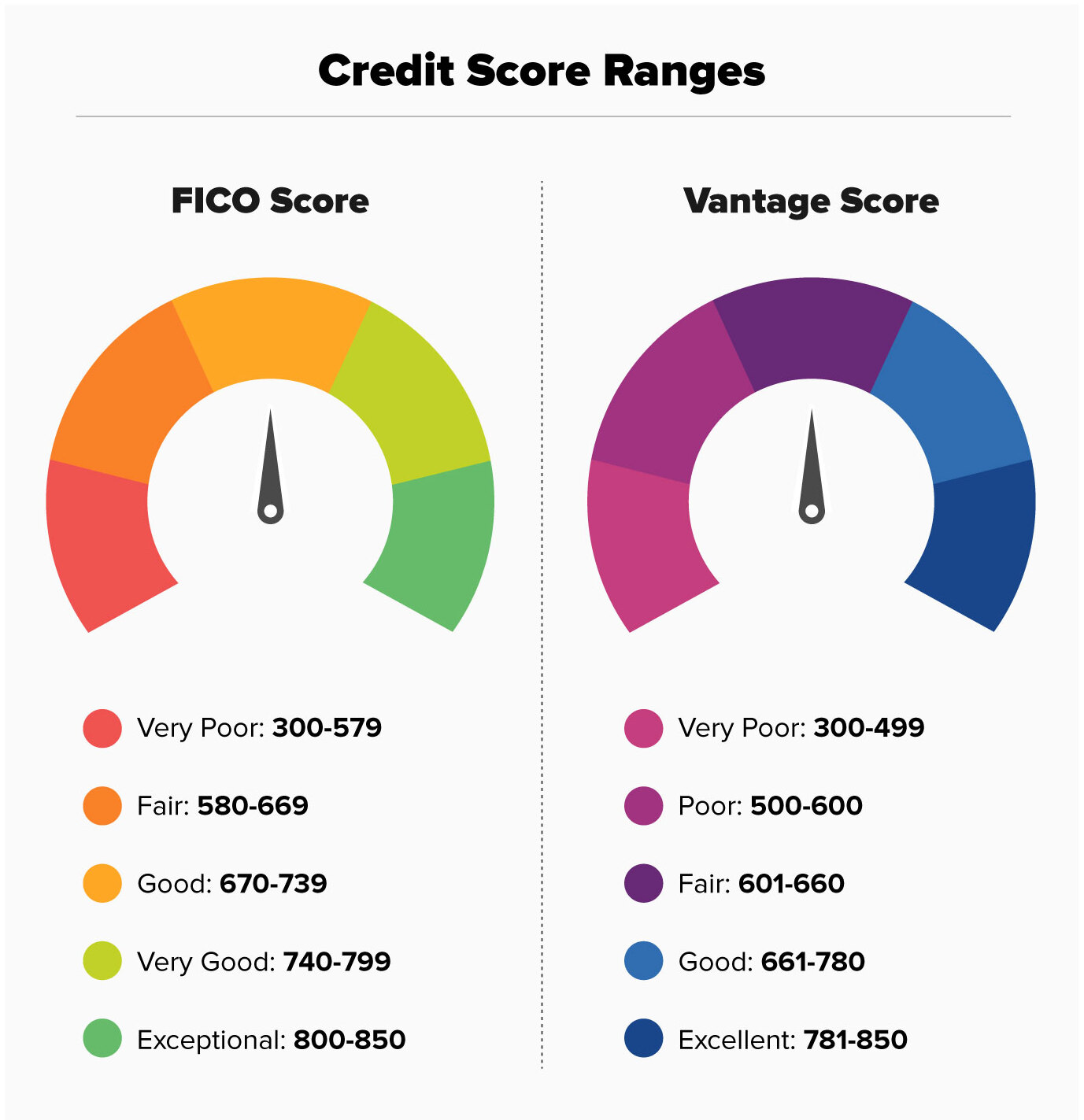

A credit score is a three-digit number that is calculated from information on a credit report and generally ranges between 300 and 850. A good credit score is 670 to 739 on the FICO® Score range, while a credit score of 661 to 780 is good on the VantageScore® range.

A credit score ranges from 300 to 850 and is a numerical rating that measures a person's likelihood to repay a debt. A higher credit score signals that a borrower is lower risk and more likely to make on-time payments. Credit scores are often used to help determine the likelihood someone will pay what they owe on debts such as loans, mortgages, credit cards, rent and utilities.

Lenders can use credit scores to evaluate loan eligibility, credit limits and interest rates.

For scores in the range of 300 to 850, generally a credit score of 700 or higher is considered good. A score of 800 or higher within the same range is considered excellent. Most consumers have a credit score between 600 and 750. Average FICO® Score for the United States in 2021 scored 714, up 4 points from the previous year. The higher your score, the more confident your creditors are that you will pay your future debts as agreed. However, lenders may also set their own definition of a good or bad credit score when evaluating consumers for loans and credit cards.

This partly depends on the type of borrower you want to attract.

Lenders can also consider how current events may affect consumer credit ratings and adjust claims accordingly. Some lenders create their own credit scoring programs, but the most commonly used are the two credit scoring models developed by FICO® and VantageScore®.

FICO® creates various types of consumer loans. There are industry-specific credit ratings for credit card issuers and auto lenders, as well as "core" FICO® ratings that companies use with lenders in a variety of industries.

The baseline FICO® score range is 300 to 850 and FICO defines a “good” range of 670 to 739. FICO® credit scores by industry range from 250 to 900. However, the middle category has the same value.

The first two VantageScore credit scoring models range from 501 to 990.

The two most recent VantageScore credit scores (VantageScore 3.0 and 4.0) use the same 300-850 range as the basic FICO® score. For newer models, VantageScore defines a range of 661 to 780 as a good range.

Common factors can affect all your credit scores, and these are often split into five categories:

Payment history: Making on-time payments on your credit accounts can help your scores. But missing payments, having an account sent to collections or filing bankruptcy could hurt your scores.

Credit usage: How many of your accounts have balances, how much you owe and the portion of your credit limit that you're using on revolving accounts all come into play here.

Length of credit history: This category includes the average age of all your credit accounts, along with the age of your oldest and newest accounts.

Types of accounts: Also called "credit mix," this considers whether you're managing both installment accounts (such as a car loan, personal loan or mortgage) and revolving accounts (such as credit cards and other types of credit lines).

Showing that you can manage both types of accounts responsibly generally helps your scores.

Recent activity: This considers whether you've recently applied for or opened new accounts.

FICO® and VantageScore take different approaches to explaining the relative importance of the categories.

FICO® uses percentages to represent generally how important each category is, though the exact percentage breakdown used to determine your credit score will depend on your unique credit report. FICO® considers scoring factors in the following order:

Payment history: 35%

Amounts owed: 30%

Length of credit history: 15%

Credit mix: 10%

New credit: 10%

VantageScore lists the factors by how influential they generally are in determining a credit score, but this will also depend on your unique credit report.

VantageScore considers factors in the following order:

Total credit usage, balance and available credit: Extremely influential

Credit mix and experience: Highly influential

Payment history: Moderately influential

Age of credit history: Less influential

New accounts opened: Less influential

In general, having good credit can make achieving your financial and personal goals easier. It could be the difference between qualifying or being denied for an important loan, such as a home mortgage or car loan. And, it can directly impact how much you'll have to pay in interest or fees if you're approved.

For example, the difference between taking out a 30-year, fixed-rate $250,000 mortgage with a 670 FICO® Score and a 720 FICO® Score could be $72 a month. That's extra money you could be putting toward your savings or other financial goals.

A good score over the life of the loan will save you $26,071 in interest charges.

Your credit score can also influence non-credit decisions, such as whether or not a landlord will agree to rent an apartment.

Your credit report (not including your consumer credit score) can affect you in different ways. Some employers may review your credit report before making a hiring or promotion decision. And in most states, insurance companies can use your credit score to help determine auto, home, and life premiums.

To improve your credit score, focus on the main factors that affect your score. The basic steps you need to take at a high level are pretty straightforward.

Pay at least the minimum amount and pay off all debts on time. Even one late payment can damage your credit history and it will be recorded on your credit report for up to 7 years. If you believe a payment is missing, contact your creditor as soon as possible to see if we can work with you or come up with a solution.

Keep your credit card balance low.

Your credit usage level is an important score that compares your credit limit to your current balance on a revolving account, such as a credit card. A low credit utilization rate can benefit your credit history. Those with good credit ratings tend to have single-digit overall utilization rates.

Opening of accounts for reporting to credit bureaus. If you don't have many credit accounts, see if the accounts you open add up to your credit report.

These can be installment accounts such as student, car, home or personal loans, or revolving accounts such as credit cards and lines of credit.

Apply for credit only when you need it. Applying for a new account can result in complex investigations that can slightly damage your credit history. Although the impact is often minimal, applying for various types of loans or credit cards in a short period of time can cause a larger drop in your score.

Other factors may also affect results.

For example, increasing the average age of accounts can improve results. But more often than not, we just wait rather than take action.